How rebel calculates her edge is not a secret nor anything sophisticated, they simply scan pinnacles odds and remove the margin using the “equal margin removal method” to get true odds and display value based on that.

This rebel software is a great software no doubt, but also very very basic, for people starting betting it’ll do and for some pros.

The losing streaks you’re facing are not rebels fault by any means, its not that they’re giving you losing picks or giving you inefficient markets, the very basic thing this software does is

i. Scan pinnacles odds

ii. Remove Vig using equal margin(not the most efficient method as this doesn’t really factor favourite long shot bias on long odds) to get fair odds

iii. Calculate and display edge.

So from this, you see that they’re nothing but middle men and have no power over how your bets perform, everything stems from the notion that pinnacle is efficient and if one doubts this notion then simply don’t take the bets.

Sure there’s more the software can offer in terms of customisation but their performance/yield is solely based on how efficient pinnacles markets are(and maybe BF Exchange).

How many moderators are there? Horrible advice? ![]()

I frequently use 4% max stake. I do not have any issue with that. If you want to reduce variance then reduce the fractional Kelly to 25 or 20%. For you to hit the 4% max stake limit you need high value and high probability. That are the kind of bets where I do not mind putting 4%! Max stake at 1% truncates the Kelly way too early - might as well do flat staking.

Do you know for a fact that that is how the RB software operates or you are guessing or speculating?

I normally sort after time-to-start. I know that RB says (they are the ones sitting on the huge data set) that there is only a weak correlation between TTS and CLV and that might be the case but I still prefer bets close to start.

Speculating from observation.

4% is definitely horrible advice, unless the value is really high. CLV would have to be atleast over 8% for those.

Your reply does not make sense and you proved my point.

CLV of over 8% happens pretty much never, so it doesn’t prove any point. People solely relying on the software should never place bets of 4%.

Of any of the sources that I used for +EV betting, I do get the largest swings (variance) from Rebel Bets. I attributed it to pricing in shallower markets on the leagues they offer from the books that I use.

I would like them to show the lines from multiple books for comparison like OddsJam and PickTheOdds do. This allows me to devig and do my own calculations using other methods. It would also be nice for them to use more sophisticated calculation methods given the wide depth of books they offer.

That is so weird that you write that.

It would be as if I would claim that people “solely relying on the software should never place bets of 2%…”.

What is the basis of the claim? How do you know what % is ideal? How do you combine it with the fractional Kelly?

I have been doing between 3 and 5% and it has all been good.

You think 4% is horrible and I do not mind using it.If you want to keep discussing then open a new post so the discussion does not impact @tharpjay original question.

This certainly looks very unlucky, and statistically very unlikely. A few notes below.

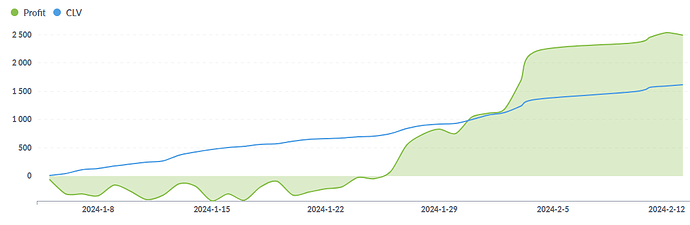

First, you cannot equate the CLV to the expected yield, especially not after just 400 bets! These two numbers will eventually align, but it takes thousands of bets.

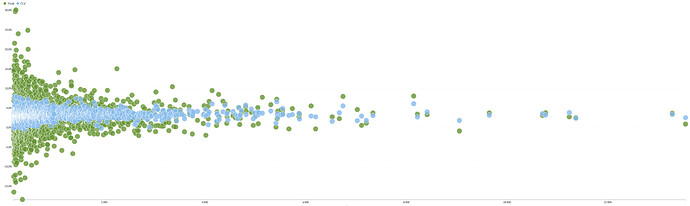

Here is yield (green) and CLV (blue) for 3 months. You can see that the yield swings wildly until after around 2-3000 bets:

Second, the majority of your losses are from tennis, which is a sport that has the highest variance, together with esport. One reason for this is because tennis is a sport with just two participants, and the probabilities are just harder to forecast.

(And a small information advantage can give large benefits).

This does not mean the yield will be lower on these sports (often the opposite over time), but it will take longer for the law of large numbers to align the yield with the CLV.

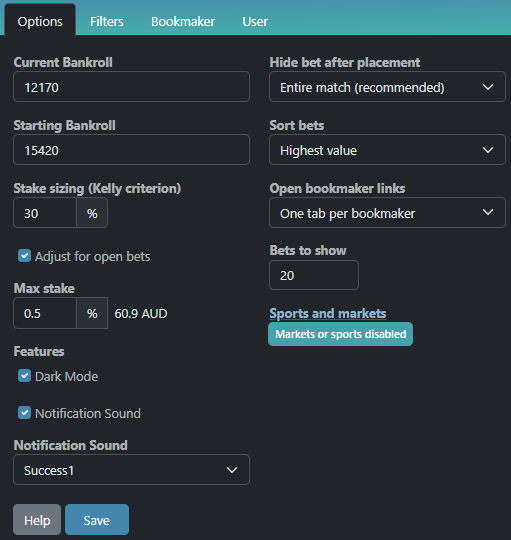

Third, 4% max stake is also considered very aggressive, especially when starting out! There is a reason we don’t recommend this. An unlucky streak of losses can wipe out a large part of your bankroll.

However, if you have a large bankroll and you’re willing to accept higher variance and larger downswings, 4% max stake can absolutely work. But it’s never something I would recommend until you have many thousands of bets.

I assume you’re running 30% Kelly. If you can DM me your username I can take a closer look at your bets and your strategy. The bets you logged this summer looks great, but I guess you have created a new user?

Nice! I just took a quick glance, and it looks like you’re calculating probability from the soft odds? (Average odds displayed in VB is soft odds).

The probability should be the sharp fair odds, with removed proportional margin.

This is incorrect. First, we use more than one sharp and secondly we don’t use the naive equal margin model.

(As a moderator, please be more careful not to make false claims).

You do you then ![]() let’s hope you don’t get any major downswings since they might eat up your bankroll quite fast.

let’s hope you don’t get any major downswings since they might eat up your bankroll quite fast.

I’ve asked @tharpjay to post his updated results since his first post.

Until then, I’ll just leave this here ![]()

Then he should expect a downswing… ![]()

Seriously, it is nice to see posts when there is a positive result to balance out the “unluckiest” run ever!.

I have had a pretty unlucky start as well. Sometimes I feel like I should bet the opposite of rebelbetting.

What settings are you using?