I know this has been discussed before but I never seen a good response from the RB owners on this topic.

We need to see the closing line for each bet but, but more importantly we need to see the current edge as the market is “Dynamic” & the kelly criterion is been used for staking with almost everyone.

Let me explain you why, a bet comes in at 10% edge odds 2.00 → You stake 1.5% of your total bankroll on this bet because it has a high edge. (24h before the game starts)

1 hour later your 10% edge totally melts away because the underlying benchmark (sharp pricing) has totally swung the other way. You now face exposure on something that had 10%+ EV to -10% negative EV. Which means you are overly exposed on something that you definitely don’t want any exposure on in that senario.

Seeing some of the edge dissapear can be normal because of the natural arbitrage opportunity that will come along (Pinnacle will get smashed on the other side and therefore naturally adjust their pricing).

But then this is likely to widen again if the original “Edge” is deemed a true “edge”

Bookmakers like Bet365 allow you to cash out your placed bets at Par(Original Amount Placed) for quite sometime, which will give you to opportunity to take risk of the table at 0 cost!

You could stake in tranches on a single game and reduce some of the exposure

You could take the bet of completely

You could hedge the bet at a small loss 2-3% at a sharp bookmaker or exch…

Seeing current edge will simply allow you to make better risk management decisions and this will enhance returns drastically in the future.

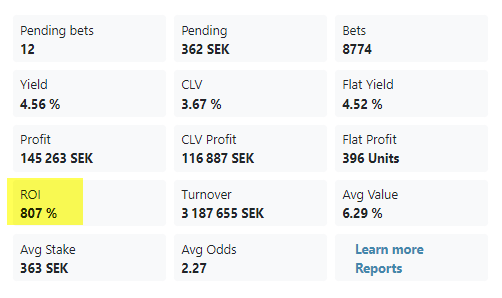

I have a subscription under my other email adres and we had some amazing results with Rebelbetting almost 9% yield over 4500 bets. But this was more luck than skill and my research shows that if you can get your money in with kelly criterion on True edges you will dramatically enhance your returns.

So for now the service is simply not worth 170 euro’s in my view, because the system does not allow you to manage your exposure and therefore actually takes potential extra returns away from you.

There is also a narrative with value betting providers to guide you on keeping your account running as long as possible. This is of course total Bullshit as well, Valuebetting providers are biased in sharing those “tips” because they want you to stay as long as possible betting, with a small profit rather than large because the monthly fee.

What really should be thought is how to enhance returns, and of course you don’t want to burn an account immediately. But you actually want to make the largest profit possible in the shortest amount of time because you have subscription costs and time you invest in doing Valuebetting.

I hope this gives you guys some food for thought and a response would be welcomed.