Hey,

anyone out here from Germany who successfully uses RebelBetting for value bets?

I signed up two weeks ago and started value betting pro.

As we have 5% tax mostly on profit on all available bookies except for sharps I asked support for help because my average value is around 5.5% now but my CLV remains very low. As I found out the tax is not taken into account when calculating CLV. This would mean that I have to realize a CLV >5% to make profit long term, or am I getting something wrong?

Do u find good value on sharps and exchange?

I think you got it wrong.

RB will provide you with average VBs of 5%. The closing line will be 3.5%. Which means your long term profit will be around 3.5% on your turnover.

Your tax will be 5% of that profit. So remaining profit is 95% of the 3.5%.

Unless you have tax on the turnover which would force you to chase a higher closing line.

Thanks for your answer.

That’s similiar to what I thought at first.

As I have typed in the tax for every bookmaker, RB provides me (on my latest results) bets with a net value of 5% at time of the placement. So as CLV is typically about 2-3% less than Avg.Value my CLV should also be around 2-3% on the long run. The thing what is a bit weird to me is that RB support told me that for Avg.Value (as stated in my results table) the tax is taken into account as my “personal odds”, so the net odds with tax already deducted, BUT for the CLV (in my results table) it is NOT taken into account for calculating this. This is what concerned me as my CLV is around 1% now while Avg.Value is up to 5.5%.

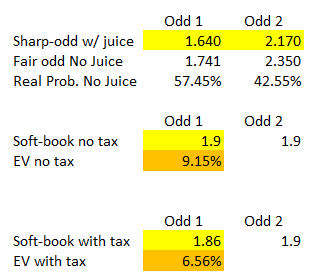

Let me explain with an example.

I’m taking a bet with 5% value (my personal value), so the value for users without tax is probably 10%. To make it easy i will assume that CLV is in general about 3% lower than the value at bet placement. This would mean that my personal CLV is 2%, for users without tax it is 7%.

As RB support told me, the percentage of CLV calculated in my personal results table is calculated without tax (other than the Avg.Value, where tax is deducted!), the CLV should show 7% for me as well. As mentioned earlier, my CLV is around 1% now, so when deducting the tax of 5% for profit i will have negative CLV.

If I place a bet with odds of 2.00, then my net odds are 1.90 with 5% tax. If the line closes out at 1.90 fair odds, I would have no profit on the long run while the CLV on RB is showing me positive. (Original statement from support: “German tax is not taken into account when calculating CLV, as it’s the bookmakers odds related to the “truth-bookmaker” closing line odds.”)

If the CLV shown in my results would be calculated with tax (with my net odds), then everything would be fine. But RB told me otherwise. I asked them again via support chat for help but unfortunately I got no answer for about 4 days now ![]()

You are mixing up the percentages. The CLV is, like RB said, the value of the odds compared to the sharpest bookmaker (which I assume is Pinnacle). If the CLV is positive and you ONLY pay tax on the profit (5% tax) then you can not loose money. With average CLV of 3% then you should expect 3% profit on the turnover (many bets and long-term).

After tax deduction 95% of profit remains so your profit would be 95% x CLV(3%) = 2.85%. So it is 2.85% vs. 3%.

That was a weird place to post that question. What has that got to do with the original question?

Because here nobody seems to use the pro version and I wanna understand why

As a guess, RB probably removes the 5% of the tax from the odd you bet and then recalculates the EV%.

See example below.

FYI, 1.86 = 0.9 * (0.95) + 1

In theory, if your average value after tax is relatively high (+5%), your CLV after tax should be positive (≈3%).

This seems like a rather odd way of calculating. As i see it, betting can hardly be profitable in Germany with that tax. Just as a counter example, lets imagine the tax was 100% on profits. You would then calculate 0% x CLV (3%) = 0%. This obviously isn’t the case.

I haven’t thought it completely through tough

Let’s improve this. See here: Help me understand taxes - #4 by Bjorn

I replied to that post, and perhaps i could look up some more bookies. I speak German.

However what I am commenting on here is the way @totrashbin01 calculates CLV, including taxes. Seems to be faulty thinking in my opinion.

KR

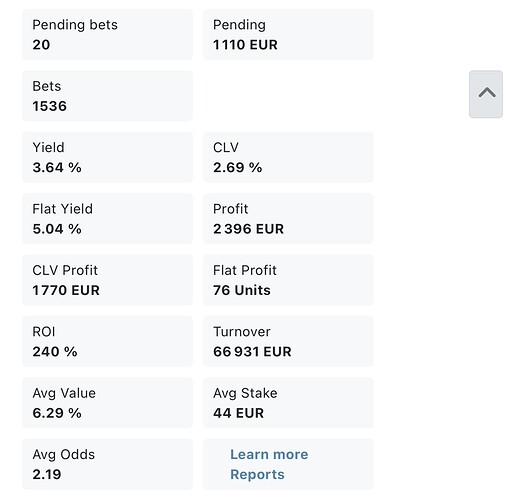

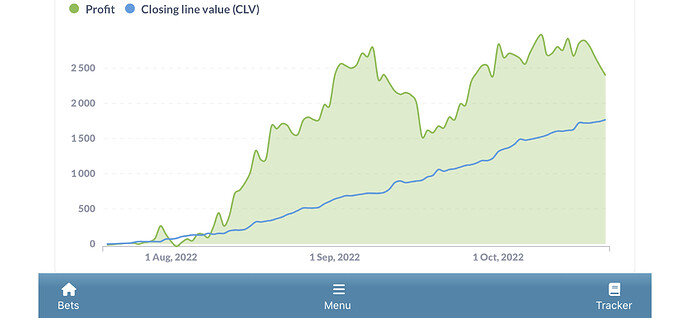

After about 1500 bets I think it’s time to show my results. I was worried about the answer from the RebelBetting support saying taxes are not deducted from CLV, but in my opinion that was not right or they didn’t understand what I meant to say.

Seems to be profitable anyway, even though you don’t get too much bets per day.

Sorry, I’m not going to ask regarding taxes.

Which bookies are you using in Germany?